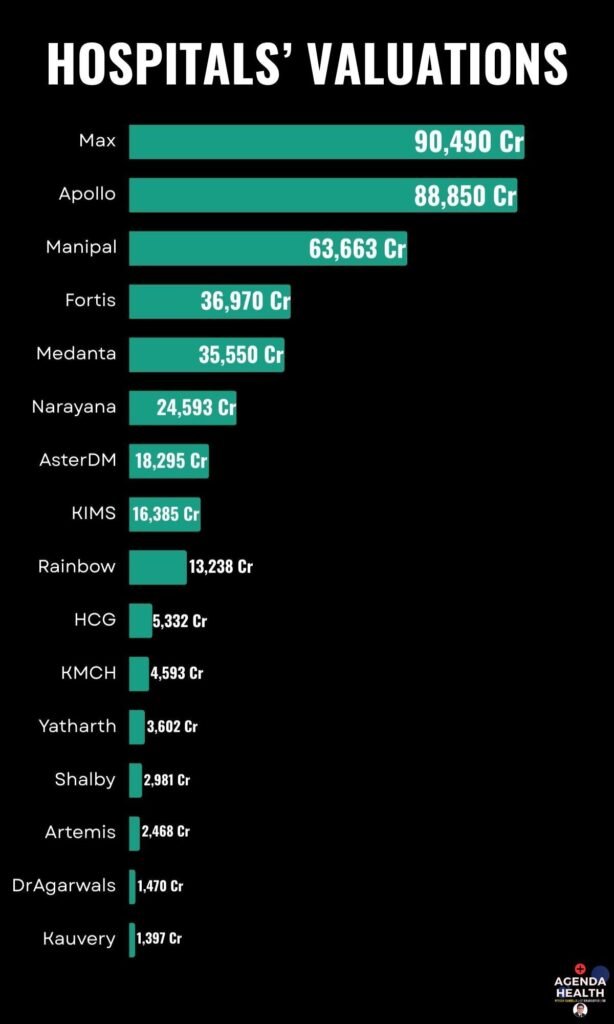

Over the past four years since the COVID-19 pandemic, the market valuations of Indian hospitals have soared to astonishing heights. One of the most surprising developments is that Max Healthcare has overtaken Apollo Hospitals in market valuation. Let’s dive into the numbers and explore the factors behind this unexpected trend.

Current Valuations of Major Indian Hospitals (in Rs. Crores)

- Max Healthcare – 90,490Cr (surprising!!)

- Apollo Hospitals – 88,850Cr

- Manipal Hospitals – 63,663Cr*

- Fortis Healthcare – 36,970Cr

- Medanta – 35,550Cr

- Narayana Health – 24,593Cr

- Aster DM Healthcare – 18,295Cr

- KIMS Hospitals – 16,395Cr

- Rainbow Children’s Hospitals – 13,238Cr

- HealthCare Global – 5,332Cr

- Kovai Medical Center and Hospital (KMCH) – 4,593Cr

- Yatharth Super Speciality Hospitals – 3,602Cr

- Shalby Hospitals – 2,981Cr

- Artemis Hospitals – 2,468Cr

- Dr.Agarwal’s Eye Hospital – 1,470Cr

- Kauvery Hospital – 1,397Cr

What’s Driving This Phenomenal Growth?

The surge in valuations can be attributed to several key factors:

- Private Equity (PE) Investments and Mergers & Acquisitions (M&As):

- Temasek Holdings: This Singaporean investment giant has been instrumental in the growth of Indian hospitals. It bought an additional 41% stake in Manipal Hospitals by pumping in $2 billion, valuing it at Rs. 40,000Cr. Since then, Manipal’s revenue has jumped by 59%, leading to an assumed proportional increase in its valuation. Temasek also:

- Acquired Medica Superspecialty Hospital, expanding Manipal’s footprint across 11 hospitals in Bihar, West Bengal, Jharkhand, and Assam.

- Bought a 17% stake in Medanta from Punj Lloyd Limited.

- Invested $80 million in Dr.Agarwal’s Eye Hospital.

- IHH Healthcare: Acquired Gleneagles and bought a 31% stake in Fortis Healthcare.

- Blackstone: Made significant investments in KIMSHEALTH, acquiring an 80% stake.

- Temasek Holdings: This Singaporean investment giant has been instrumental in the growth of Indian hospitals. It bought an additional 41% stake in Manipal Hospitals by pumping in $2 billion, valuing it at Rs. 40,000Cr. Since then, Manipal’s revenue has jumped by 59%, leading to an assumed proportional increase in its valuation. Temasek also:

- Market Trends and Increased Healthcare Demand:

- The pandemic underscored the critical need for robust healthcare infrastructure, driving demand and investment in the sector.

- With the rise in lifestyle diseases and an aging population, the demand for healthcare services has been steadily increasing.

Is This Expansion Good or Bad?

The rapid expansion fueled by substantial investments and M&As has both positive and negative implications.

Pros:

- Improved Infrastructure and Access: Increased funding has allowed hospitals to expand their infrastructure, improve facilities, and offer better healthcare services.

- Enhanced Quality of Care: Investments in technology and staff training can lead to higher quality care and better patient outcomes.

- Job Creation: Expansion projects create numerous job opportunities in the healthcare sector.

Cons:

- Market Saturation Risks: Rapid expansion without corresponding demand can lead to overcapacity and financial instability.

- Consolidation Concerns: Large PE firms acquiring significant stakes can lead to market consolidation, potentially reducing competition and driving up healthcare costs.

- Quality vs. Quantity Dilemma: In the race to expand, there is a risk that the focus might shift from quality of care to quantity of services.

In conclusion, the sky-rocketing market valuations of Indian hospitals post-COVID are driven by a mix of aggressive PE investments, strategic M&As, and a heightened focus on healthcare infrastructure. While this trend brings many benefits, it also raises questions about sustainability and the balance between quality and quantity in healthcare delivery.

Follow AGENDA+HEALTH for more insights on healthcare trends and join our community to upskill for the future. Practicing doctors can join our platform to stay ahead in the evolving healthcare landscape.

Please follow the below links:-

Website:- https://doctorialsacademy.com/

LinkedIn:- https://in.linkedin.com/company/doctorials-academy

Facebook:- https://www.facebook.com/people/Doctorials-Academy/61558183675530/

Youtube:- https://www.youtube.com/channel/UCEukyOB7riOSdUhz68tdLzA

Instagram:- https://www.instagram.com/doctorialsacademy/