India’s hospital market was valued at US$ 98.98 billion in 2023, projected to grow at a CAGR of 8.0% from 2024 to 2032, reaching an estimated value of US$ 193.59 billion by 2032.

🇮🇳 India Healthcare Spotlight — Newsletter

Issue: October 2025

📬 From the Editor

Dear Readers,

Welcome to the October 2025 edition of India Healthcare Spotlight. In this issue, we dive into the dynamic growth trajectories, policy thrusts, investment climate, challenges, and future prospects for India’s healthcare sector — a domain that is rapidly evolving at the intersection of medicine, technology, and public policy.

Source:-https://ibef.org/industry/healthcare-presentation

1. Introduction & Sector Overview

- The Indian healthcare industry comprises a wide spectrum: hospitals, medical devices, clinical trials, telemedicine, medical tourism, health insurance, pharmaceuticals, diagnostics, outsourcing, and medical equipment. India Brand Equity Foundation

- India’s healthcare delivery is broadly segmented into:

- Public sector (central & state) — primary health centres, district hospitals, public medical colleges, etc.

- Private sector — more predominant in secondary, tertiary, quaternary care, especially in metros and Tier-I / Tier-II cities.

- India offers a competitive edge through a large pool of medical professionals, cost-effectiveness (e.g. surgeries in India often cost a fraction compared to many Western countries), and a growing foothold in global R&D and clinical trials. India Brand Equity Foundation

2. Market Size, Trends & Key Statistics

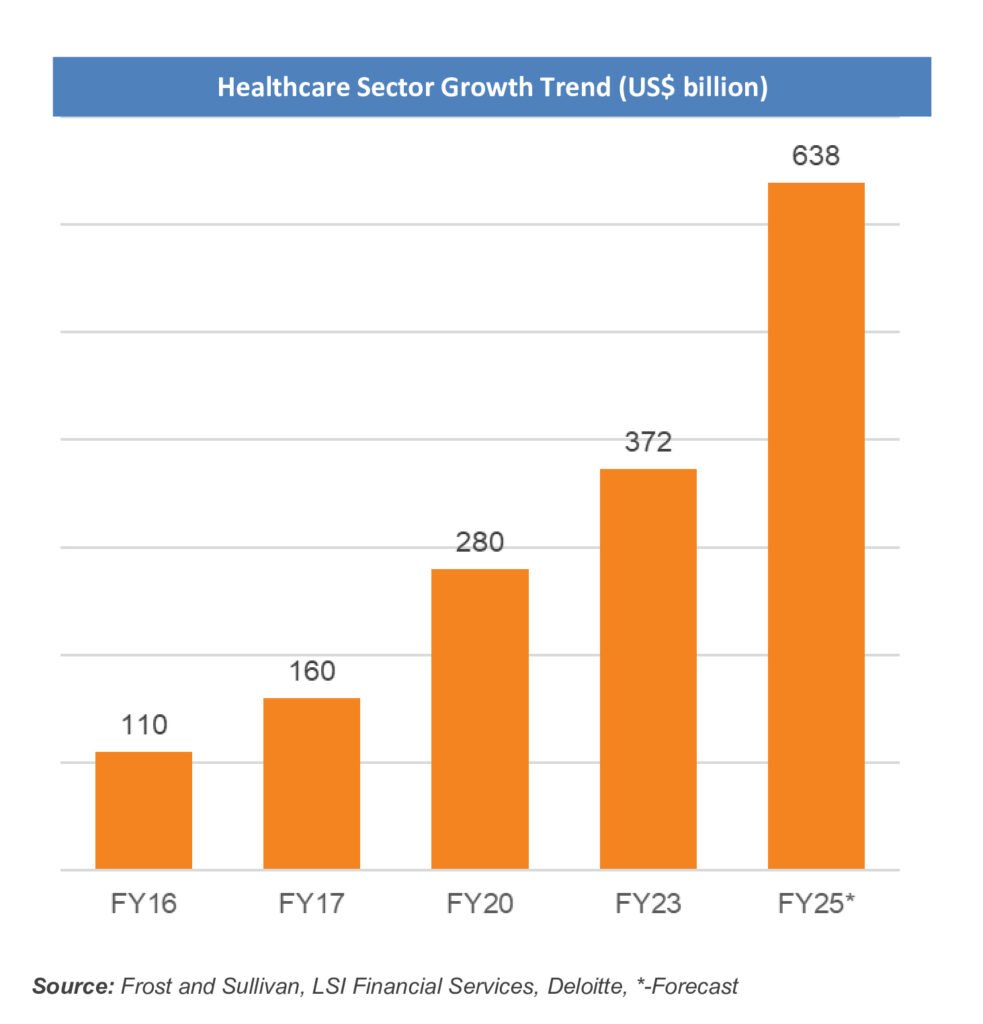

📈 Growth Trajectory

- The Indian healthcare market was valued at US$ 110 billion in FY16 and is projected to expand to US$ 638 billion by FY25. India Brand Equity Foundation

- In FY23, the sector already showed strength with a valuation around US$ 372 billion. India Brand Equity Foundation

- Hospital services, diagnostics, and pharmaceuticals are key pillars driving growth. India Brand Equity Foundation

👥 Employment & Workforce

- As of FY24, 7.5 million people are employed in the healthcare sector. India Brand Equity Foundation

- The number of healthcare professionals (doctors, nurses, allied health) is already above 6 million (CY24). India Brand Equity Foundation

- Additional 6.3 million jobs are expected to be created by CY30, reflecting strong future demand. India Brand Equity Foundation

- The ratio of doctors to patients is still skewed; approximately 1 doctor per 854 persons (assuming 80% availability of registered allopathic + AYUSH doctors). India Brand Equity Foundation

- Nursing density is lower compared to norms — e.g. 1.7 nurses per 1,000 people. India Brand Equity Foundation

💰 Public Expenditure, Insurance & Investments

- Public (government) healthcare expenditure is expected to be 1.9% of GDP in FY26, down from 2.5% in FY25, per the Economic Survey. India Brand Equity Foundation+1

- In the Union Budget 2025-26, the government allocated ₹ 99,858 crore (~US$ 11.50 billion) to the healthcare sector — about 9.78% higher than the prior year’s allocation. India Brand Equity Foundation

- A proposed credit incentive program of ₹ 50,000 crore (~US$ 6.8 billion) is planned to boost healthcare infrastructure. India Brand Equity Foundation

- Health insurance uptake is growing:

- In FY24 (till Feb 2024), health-insurance premiums underwritten reached ₹ 2,63,082 crore (~US$ 31.84 billion). India Brand Equity Foundation

- By March 2025, gross direct premium income in health rose to ₹ 37,528.92 crore (~US$ 4.39 billion) from ₹ 32,354.28 crore. India Brand Equity Foundation

- Foreign Direct Investment (FDI) in health & pharma (April 2000–March 2025) reached ₹ 2,33,399 crore (≈ US$ 27.13 billion). India Brand Equity Foundation

- For hospitals / diagnostics / medical devices:

- Hospitals & diagnostics: ₹ 1,01,687 crore (~US$ 11.82 billion) FDI inflows (2000–2025) India Brand Equity Foundation

- Medical & surgical appliances: ₹ 33,638 crore (~US$ 3.9 billion) India Brand Equity Foundation

🩺 Telemedicine, Digital Health & Medical Tourism

- The telemedicine market is projected to reach US$ 5.4 billion by FY25. India Brand Equity Foundation

- The digital health / e-health sector is set to grow strongly:

- Indian digital health market: ₹ 75,658 crore (~US$ 8,794.4 million) in 2024 India Brand Equity Foundation

- Forecast to reach ₹ 4,11,275 crore (~US$ 47,806.9 million) by 2033, with a CAGR of ~17.67%. India Brand Equity Foundation

- The e-health market is estimated to reach US$ 10.6 billion by FY25. India Brand Equity Foundation

- Medical tourism / medical value travel (MVT):

- Valued at US$ 7.69 billion in 2024, expected to grow to US$ 14.31 billion by 2029. India Brand Equity Foundation

- In 2023, about 634,561 international patients visited India for treatment (~6.87% of total foreign tourists). India Brand Equity Foundation

- India currently hosts ~500,000 international patients annually, with MVT valued at ~US$ 5–6 billion. India Brand Equity Foundation

3. Key Initiatives, Innovations & Developments

✔ Government Programs & Policy Measures

- MedTech Mitra: Launched virtually by Health Minister Dr. Mansukh Mandaviya, this platform supports innovation in medtech, helps with regulatory approvals, and aims to reduce import dependency, driving India toward a US$ 50 billion MedTech industry by 2030. India Brand Equity Foundation

- U-WIN Platform: Announced in 2024 to digitize vaccination records, improve vaccine tracking, and centralize immunization data. India Brand Equity Foundation

- MoU on Traditional Medicine: On Jan 25, 2025, India and Indonesia signed an MoU to establish quality assurance standards for traditional medicine systems. India Brand Equity Foundation

- Under “Ayushman Bharat / Quality Health” initiatives, new measures include:

- Virtual NQAS (National Quality Assurance Standards) assessments for Ayushman-Arogya Mandirs

- IPHS compliance dashboards to monitor real-time public health facility compliance

- A spot food licence initiative for food vendors in public health setups India Brand Equity Foundation

- Poshan Abhiyan (nutrition scheme): Revised guidelines issued to equip anganwadi centres with smartphones and growth-monitoring devices (infantometers, stadiometers, etc.). India Brand Equity Foundation

🏥 Infrastructure, Clinical & Tech Innovations

- Apollo Hospitals + University of Leicester: Jointly launched a Centre for Digital Health & Precision Medicine in Chittoor, Andhra Pradesh. India Brand Equity Foundation

- Iswarya Hospital, Chennai: A 12-storey facility with 14 operating rooms and 72 clinical services, equipped with AI-enabled CT/MRI machines, cath labs, and specialized care in cardiology, orthopedics, neurology. India Brand Equity Foundation

- Metropolis Healthcare + Roche Diagnostics: Launched a self-sampling HPV DNA test for cervical cancer screening, enabling women to collect samples themselves. India Brand Equity Foundation

- Tata Group + IISc Bangalore: Collaboration to set up a medical school at the IISc campus; Tata will invest ~₹ 500 crore. India Brand Equity Foundation

- Medical devices sector: Expected to grow to ₹ 4,34,350 crore (~US$ 50 billion) by FY31. India Brand Equity Foundation

- DNA Wellness: Committed ₹ 200 crore for setting up 100+ cervical cancer screening labs across India by 2027 using the “CERViSure DNA Ploidy Test.” India Brand Equity Foundation

- Apollo 24|7 & Keimed merger: Deal worth ~₹ 2,475 crore (~US$ 296 million); Advent International acquiring 12.1% stake; new entity valued at ~₹ 22,481 crore (~US$ 2.69 billion). India Brand Equity Foundation

- DocPlix: A health-tech startup raised ~₹ 1.2 crore (~US$ 0.14 million) to digitize health records at scale across India. India Brand Equity Foundation

- IIT Bombay + Blockchain for Impact (BFI): Received US$ 900,000 to develop affordable healthcare technologies as part of a broader US$ 15 million BFI-Biome initiative. India Brand Equity Foundation

- Temasek & Manipal Health Enterprises: In May 2023, Temasek invested US$ 2 billion in Manipal Health, showing investor confidence in India’s healthcare potential. India Brand Equity Foundation

- Major M&A: In Sept 2023, Nirma acquired 75% of Glenmark Life Sciences (~US$ 689 million) — one of the largest healthcare deals in India. India Brand Equity Foundation

4. Challenges & Risks

While the outlook is promising, several challenges persist:

- Public expenditure still low: At ~1.9% of GDP (projected) by FY26, India lags behind many comparable emerging and developed economies.

- Workforce shortage / uneven distribution: Despite growth in numbers, personnel (especially specialists, nursing staff) remain concentrated in urban regions.

- Regulatory & compliance barriers: Delays, fragmented regulation across states, and complex approvals can slow device / pharma innovations.

- Technology adoption gap: While digital health is rising, many rural / remote areas still lack infrastructure (internet, electricity, digital literacy).

- Quality / affordability balance: Ensuring high standards of care while keeping costs manageable is a continuing tension.

- Data security & privacy: Growth in digitization and health data requires robust safeguards to guard patient privacy and data misuse.

- Health inequities: Rural–urban, state-wise, and socio-economic disparities remain stark, especially in preventive care, diagnostics, and access to specialty services.

5. Outlook & Future Opportunities

- India’s healthcare sector is multi-segmented and offers opportunities across providers, payers, medtech, diagnostics, telehealth, wellness, and preventive medicine. India Brand Equity Foundation

- With rising incomes, an ageing population, increased health awareness, and shifting attitudes toward preventive care, healthcare demand is expected to accelerate. India Brand Equity Foundation

- Health insurance penetration is likely to deepen, boosting formal health financing.

- Smart hospitals, AI diagnostics, genomics, point-of-care devices, remote monitoring, wearable health tech — all are promising growth domains.

- Medical tourism has vast runway — with improvements in accreditation, infrastructure, logistics, and branding, India can capture more share globally.

- Public–private partnerships (PPP), especially in underserved geographies, can help expand reach while optimizing resources.

- Venture capital and private equity will remain critical: in FY24’s first five months alone, PE/VC investments in Indian healthcare crossed US$ 1 billion — a 220% increase year-on-year. India Brand Equity Foundation

6. Headline Snapshot (At a Glance)

| Metric / Indicator | Value / Estimate |

|---|---|

| Indian healthcare market (FY25 forecast) | US$ 638 billion India Brand Equity Foundation |

| Employment in sector (FY24) | 7.5 million India Brand Equity Foundation |

| Health sector public spending (FY26 projected) | 1.9% of GDP India Brand Equity Foundation |

| Health insurance premium (FY24) | ₹ 2,63,082 crore (~US$ 31.84 billion) India Brand Equity Foundation |

| Medical tourism market (2024) | US$ 7.69 billion India Brand Equity Foundation |

| Telemedicine market (FY25 est.) | US$ 5.4 billion India Brand Equity Foundation |

| Medical devices market projection (FY31) | ₹ 4,34,350 crore (~US$ 50 billion) India Brand Equity Foundation |

7. How You Can Leverage This

- For investors / VCs: Focus on medtech, diagnostics, telehealth, health-IT, preventive / wellness platforms, data analytics, AI in healthcare.

- For startups / innovators: Engage with programs like MedTech Mitra, PPPs, and collaborate with public institutions.

- For academic / R&D institutions: There is fertile ground for translational research, clinical trials, digital health solutions, and biotech.

- For policymakers / NGOs: Strategize toward reducing regional disparities, bolstering public health infrastructure, and enabling regulatory clarity.

- For hospitals / care providers: Invest in digital transformation, telemedicine, infrastructure expansion to semi-urban / rural zones.

8. Suggested Further Reading

- The Rise of Health-Tech Startups: Bridging Gaps in Indian Healthcare by IBEF — on how startups are reshaping the healthcare landscape.

- Digital Healthcare to Witness Exponential Growth in India — a perspective on the digital healthcare evolution in India.

- IBEF’s official “Healthcare India” page which houses detailed reports, infographics, and data updates. India Brand Equity Foundation

9. Closing Thoughts

India’s healthcare journey is at a pivotal juncture. With demographic transitions, rising disease burden (both communicable & non-communicable), a tech-enabled transformation, and growing global ambitions, the sector is poised for exponential evolution. Yet, achieving inclusive access, maintaining affordability, and ensuring quality will demand coordinated action across government, private sector, academia, and civil society.

We hope this newsletter gives you a holistic perspective — from macro metrics to micro opportunities. Let me know if you’d like a localized “state-wise healthcare sector update” (say, Karnataka or Bengaluru), or a deep dive into a sub-sector (e.g. medtech, telehealth, diagnostics).

🏫 PGDHM – Your Gateway to India’s Booming Healthcare Industry

As India’s healthcare industry scales to new heights—crossing US$ 638 billion by FY25—there is a massive demand for skilled hospital administrators, healthcare managers, and operations leaders who can efficiently bridge medical services with management excellence.

Doctorials Academy proudly offers the Post Graduate Diploma in Hospital Management (PGDHM), a government-recognized, online program designed to prepare graduates for high-impact careers in this fast-growing field.

🎓 About the PGDHM Program

- Duration: 1-year comprehensive online program

- Affiliation: Offered in collaboration with Medhavi Skill University (UGC-recognized)

- Mode of Learning: 100% Online with interactive live sessions and LMS access

- Focus Areas:

- Hospital and Healthcare Administration

- Health Economics and Policy

- Quality and Patient Safety

- Healthcare Finance, HR, and Strategic Management

- Operations and Digital Health Systems

💼 Career Opportunities After PGDHM

Graduates from Doctorials Academy’s PGDHM program have the skills to work in:

- Hospitals & Super-Specialty Centres

- Health Insurance & TPA Companies

- Pharma & Diagnostic Chains

- Public Health NGOs & Government Health Missions

- Medical Tourism & Healthcare Consulting

Top Job Roles:

Hospital Administrator | Operations Manager | Quality Executive | Health Project Coordinator | HR & Training Manager | Healthcare Business Analyst

🌐 Why Choose Doctorials Academy

- Recognized by leading hospitals and healthcare networks

- Backed by expert faculty from top medical and management institutions

- Supported placement assistance and industry-linked internships

- Integrated career counselling and soft skills training

👉 Enroll Now and be part of the next generation of healthcare leaders.

Visit: www.doctorialsacademy.com

Contact: +91 9108962129 | co*****@***************my.com

Follow us on:-

Website:- https://doctorialsacademy.com/

PGDHM:- https://doctorialsacademy.com/pgdhm/

LinkedIn:- https://in.linkedin.com/company/doctorials-academy

Facebook:- https://www.facebook.com/people/Doctorials-Academy/61558183675530/

Youtube:- https://www.youtube.com/channel/UCEukyOB7riOSdUhz68tdLzA

Instagram:- https://www.instagram.com/doctorialsacademy/

Android app:- https://play.google.com/store/apps/details?id=com.edmingle.doctorialsacademy&hl=en